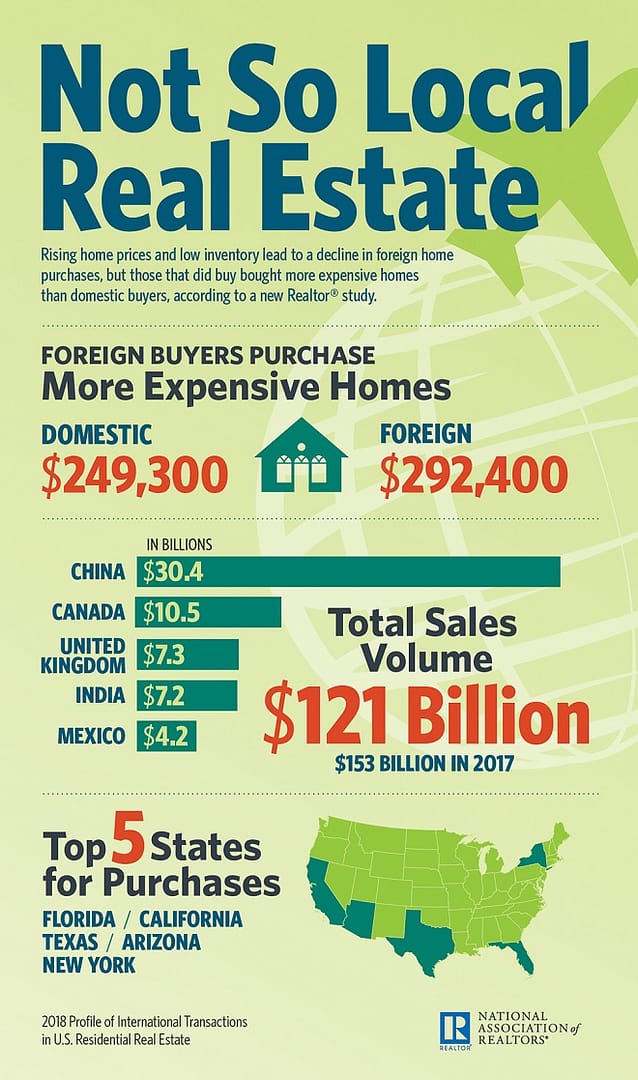

Washington, D.C. – July 26, 2018 (nar.realtor) Rising home prices and low inventory led to a decline in foreign home purchases in the United States. Total international sales totaled $121 billion during April 2017 to March 2018, a 21 percent decline from the previous 12-month period, according to an annual survey from the National Association of Realtors®.

NAR’s 2018 Profile of International Transactions in U.S. Residential Real Estate*, found that foreign buyers and recent immigrants accounted for 8 percent of the $1.6 trillion existing home sales, a decrease from 10 percent during the 12-month period that ended March 2017.

“After a surge in 2017, we saw a decrease in foreign activity in the housing market in the latest year, bringing us closer to the levels seen in 2016,” said Lawrence Yun, NAR chief economist. “Inventory shortages continue to drive up prices and sustained job creation and historically low interest rates mean that foreign buyers are now competing with domestic residents for the same, limited supply of homes.”

China continues to lead in purchases

Five countries accounted for nearly half (49 percent) of the dollar volume of purchases by foreign buyers: China, Canada, India, Mexico and the United Kingdom. For the sixth consecutive year, China exceeded all other countries in dollar volume of purchases, buying an estimated $30.4 billion worth of residential property, a decrease of 4 percent from last year. Buyers from Canada came in second, with $10.5 billion worth of property, showing a more significant decline of 45 percent from the 2017 survey reference period, followed by the U.K., $7.3 billion, India, $7.2 billion and Mexico, $4.2 billion.

“The saying goes that all real estate is local, but that does not mean that all buyers are,” said NAR President Elizabeth Mendenhall, a sixth-generation Realtor® from Columbia, Missouri and CEO of RE/MAX Boone Realty. “Even in this current global environment of political uncertainty, the U.S. real estate market continues to be seen as a safe, secure and profitable place to invest in property.”

The survey once again showed that foreign buying activity is mostly limited to three states, as Florida (19 percent), California (14 percent) and Texas (9 percent) remained the top three destinations for foreign buyers to purchase, followed by Arizona and New York (both 5 percent).

The number of units purchased by international buyers saw a slight decrease, from 284,000 in the previous 12-month period to 266,800. China, once again, purchased the greatest number of units at 40,400. Canada comes next with 27,400 units, followed by Mexico (20,200), India (13,100) and the U.K. (9,000).

International buyers purchasing fewer, less expensive properties

International buyers typically buy more expensive properties than the average existing home. The median price for a foreign buyer was $292,400, compared to the median price for all existing homes ($249,300). Chinese buyers continue to purchase the most expensive properties, with a median price of $439,100.

Foreign buyers are more likely to purchase a home with all cash than a domestic buyer. Forty-seven percent of all international transactions were reported as all cash, compared to 21 percent of existing-home sales. Buyers from India are more likely to finance their home purchase through a U.S. mortgage (78 percent). Buyers from Canada are the most likely to purchase a home through an all-cash sale (78 percent).

Foreign buyers are most likely to purchase a detached, single-family home (66 percent), followed by a condominium (14 percent) and then a townhouse (13 percent). Only 3 percent of international buyers purchase residential land with the intent to build a home.

International buyers purchase property for a variety of reason, the most frequent (52 percent) being as a primary residence. Indian buyers were the most likely to purchase the property for primary residence (86 percent), while Canadian buyers were the most likely to purchase the property as a vacation home (40 percent). Among the top five purchasing countries, Chinese buyers were the most likely to purchase a house for student housing.

Realtors® uncertain about the outlook of international buying activity

Twenty-three percent of National Association of Realtors® members who participated in the survey reported that they worked with an international client in the last year, a decline from 29 percent in the previous year. Forty-four percent of respondents said that they “don’t know” when asked about the 12-month outlook for international residential buyer activity. Twenty-five percent said they think the activity with either decrease or remain the same and only 5 percent believe it will increase. Yun attributes this uncertainty about future conditions to confusion and ambiguity surrounding policy changes related to international trade and immigration.

Realtors® also worked with international clients looking to lease property in the U.S. Eleven percent of respondents said they helped a foreign client lease residential property, with the most frequent country of origin being Canada (4 percent).

NAR’s 2018 Profile of International Transactions in U.S. Residential Real Estate was conducted April 10 through April 19, 2018. A sample of Realtors® was surveyed to measure the share of U.S. residential real estate sales to international clients, and to provide a profile of the origin, destination and buying preferences of international clients, as well as the challenges and opportunities faced by Realtors® in serving foreign clients. The survey presents information about transactions with international clients during the 12-month period between April 2017 and March 2018. A total of 10,303 Realtors® responded to the 2018 survey.

The 2018 Profile of International Transactions in U.S. Residential Real Estate can be ordered by calling 800-874-6500, or online at realtor.org. The report is free to NAR members and accredited media and costs $149.95 for non-members.

The National Association of Realtors® is America’s largest trade association, representing 1.3 million members involved in all aspects of the residential and commercial real estate industries.

* Members of the media can contact Jane Dollinger at jdollinger@realtors.org (link sends e-mail) for a full copy of the report.

Media Contact:

Jane Dollinger

(202) 383-1042

Email

Like this:

Like Loading...