– A slowing housing market doesn’t mean it has suddenly become a good time for prospective home buyers as rising rates keep mortgage payments climbing.

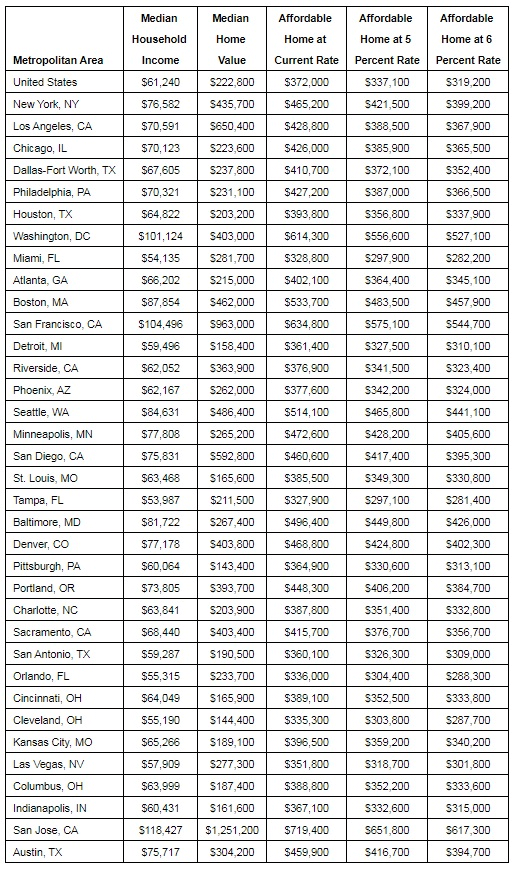

– If rates reach 6 percent, the typical U.S. buyer will have $52,800 less to spend on a home.

– The brunt of rate increases is felt most sharply in pricey places like San Jose – where shoppers might soon be looking at homes $100,000 less expensive – Washington, D.C., and Boston. It most lightly hits pocketbooks in Miami and Tampa.

– Nearly 50,000 additional homes become unaffordable for a typical U.S. buyer purchasing at a 6 percent rate rather than the current rate.

Seattle, WA – Dec. 27, 2018 (PRNewswire) Home-value growth is slowing, price cuts are more common and for-sale inventory is up. Sounds like relief is imminent for home buyers, right? Not so fast. Mortgage rates have been steadily climbing for the past two years and could approach 6 percent by the end of 2019, dulling those factors.

Rising interest rates bite into buyers’ budgets more than they might think. For example, a buyer making the current U.S. median household income could have bought a $393,700 home in January 2018, spending 30 percent of that salary each month on a mortgage payment.i That’s when rates were at 4.15 percent. Now, with rates at 4.63 percent, that same buyer can only afford a $372,000 home to keep the monthly payment the same. If the mortgage rate hits 6 percent, that buyer will be shopping for a $319,200 home in order to maintain the budget, according to a Zillow® analysis. Home values have risen steadily this year, and continued appreciation – albeit more slowly – is expected at least through next year.

The result is that many home buyers in 2019 will need to reset their price points, with some making concessions about where they’re willing to live or how much space they want. Buyers being pushed toward less-expensive segments of the market where inventory is also the tightest could, in turn, push prices more quickly upward, making those homes less affordable. Right now, home shoppers wanting to spend no more than 30 percent of their median U.S. income can afford 56.5 percent of available homes. With rates at 6 percent, they would be looking among 48 percent of available homes – a loss of 49,660 potential homes.

The rise is felt more sharply in some metro areas than others. In San Jose, the nation’s most expensive metro, a 6 percent mortgage rate would have buyers making the $118,400 median household income looking at homes $102,100 less expensive than those they might be considering now. In Washington, D.C., they’d be looking at homes $87,200 less expensive. In each of the 35 largest metro areas in the U.S., the drop in buying power is at least $46,500.

Already, rising mortgage payments eclipse home-value gains, a phenomenon that can both encourage homeowners to stay put to hold onto low mortgage rates and discourage would-be first-time home buyers. What prospective home buyers should take away from all this is that there isn’t necessarily a “best time” to buy a home. Trying to time the housing market, like trying to time any market, is generally a bad idea.

“While it’s certainly important to keep track of home values and interest rates and plan your budget accordingly, buyers shouldn’t base their decisions on those moving targets. A home is the most valuable asset that most people will ever own, so it’s especially important not to gamble with it,” said Zillow senior economist Aaron Terrazas. “In the end, the best time to buy a home is always when the time is right for an individual buyer – often when they’re financially ready, when they’re relocating to a new area or a major life event requires them to upsize or downsize. It’s also important to remember that rates on a typical mortgage remain very low by historic standards – especially given the type of strong economic growth we’ve been experiencing.”

Although rising mortgage rates will affect home buyers first, renters will not be far behind. As higher rates limit the number of homes that potential buyers can afford, some would-be buyers will be too financially stretched to buy and will continue renting. As a result, rent growth is expected to tick upward.

Zillow

Zillow is the leading real estate and rental marketplace dedicated to empowering consumers with data, inspiration and knowledge around the place they call home, and connecting them with great real estate professionals. In addition, Zillow operates an industry-leading economics and analytics bureau led by Zillow Group’s Chief Economist Dr. Svenja Gudell. Dr. Gudell and her team of economists and data analysts produce extensive housing data and research covering more than 450 markets at Zillow Real Estate Research. Zillow also sponsors the quarterly Zillow Home Price Expectations Survey, which asks more than 100 leading economists, real estate experts and investment and market strategists to predict the path of the Zillow Home Value Index over the next five years. Launched in 2006, Zillow is owned and operated by Zillow Group, Inc. (NASDAQ: Z and ZG), and headquartered in Seattle.

Zillow is a registered trademark of Zillow, Inc.

(i) Presuming a 20 percent down payment and 30-year fixed mortgage.