How much space can $1 million buy you in a major city? In some places, not much more than a closet. Here’s how some of the world’s priciest cities compare.

How much space can $1 million buy you in a major city? In some places, not much more than a closet. Here’s how some of the world’s priciest cities compare.

– Home values in both Las Vegas and San Jose have doubled since the lowest point of the housing crisis, but Las Vegas has still not regained all of its lost value

– Home values are higher than ever in more than half of the largest U.S. metros.

– The typical U.S. home has gained 36.5 percent in value since the market hit bottom in 2011, and is now 5 percent more valuable than at the height of the housing bubble.

– Las Vegas home values remain 19 percent below the peak reached during bubble; San Jose passed its previous peak in 2014.

Seattle, WA – Jan. 25, 2018 (PRNewswire) The U.S. housing market has gained back all $9 trillion in value it lost when the market collapsed, but the uneven nature of the crisis and subsequent recovery has left many housing markets trailing behind, while others surge further ahead.

More than half of the nation’s largest housing markets have regained all of the value lost during the recession, with the typical U.S. home worth $55,200 more than it was at the bottom of the housing bust, according to a new Zillow® report.

When the housing bubble burst in 2007, home values plummeted, and the typical American home lost 23 percent of its value. Since then, national home values have returned to their previous level, but the recovery has not been the same in all regions of the country. West Coast markets have seen the strongest gains in home value, driven by healthy job growth and limited inventory exacerbated by limitations on new construction. The Sand States that saw the biggest losses when the housing market crashed have yet to fully recover.

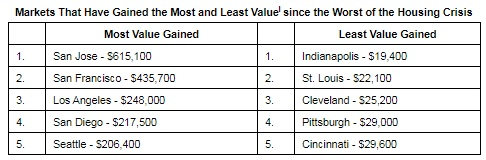

The median home in both Las Vegas and San Jose lost about $190,000 during the housing crisis. However, the Las Vegas housing market was hit especially hard during the recession – that $190,000 equaled a 62 percent loss in value – and its recovery is still lagging, with home values only recovering $131,000 so far. In San Jose, homes have gained $615,100 in value since the crisis, more than three times what was lost.

“A decade after the financial crisis, the scars of the housing bust are still with us,” said Zillow Senior Economist Aaron Terrazas. “The gap between the metros with the strongest and weakest housing market recoveries is as wide as it has ever been. The California Bay Area’s housing recovery stands out when compared to other markets that saw similar home value appreciation because it has more than regained all of its lost value. Strong, high-paying job markets and persistently limited inventory sent prices skyrocketing, leading to the Bay Area having the most valuable housing markets in the country.”

Nationally, home values hit their lowest point in December 2012. Individual markets bottomed out between July 2011 and December 2012.

Denver home values fell just over 9 percent during the housing crisis, less than half of what the typical American home lost in value, largely because the Denver housing market never experienced much of a boom during the bubble years. As Denver has emerged as a popular tech hub over the past decade, its home values have climbed rapidly. The median home in Denver is worth $379,500, about 61 percent more than the highest value reached during the mid-2000s bubble.

Zillow

Zillow is the leading real estate and rental marketplace dedicated to empowering consumers with data, inspiration and knowledge around the place they call home, and connecting them with the best local professionals who can help. In addition, Zillow operates an industry-leading economics and analytics bureau led by Zillow’s Chief Economist Dr. Svenja Gudell. Dr. Gudell and her team of economists and data analysts produce extensive housing data and research covering more than 450 markets at Zillow Real Estate Research. Zillow also sponsors the quarterly Zillow Home Price Expectations Survey, which asks more than 100 leading economists, real estate experts and investment and market strategists to predict the path of the Zillow Home Value Index over the next five years. Launched in 2006, Zillow is owned and operated by Zillow Group, Inc. (NASDAQ: Z and ZG), and headquartered in Seattle.

(i) Value gained is for the median home in each metro.

Stock Market Rally Drove Demand for High-End Homes as Supply Waned for the Third Consecutive Quarter

Seattle, WA – Jan. 25, 2018 (PRNewswire) (NASDAQ: RDFN) Luxury home prices rose 7.4 percent year over year to an average of $1.76 million in the fourth quarter of 2017, according to the latest luxury market report from Redfin (www.redfin.com), the next-generation real estate brokerage. The analysis tracks home sales in more than 1,000 cities across the country and defines the luxury market as the top 5 percent most expensive homes sold in the city in each quarter. The average price for non-luxury homes was $333,000, up 6 percent compared to a year earlier.

Persistent demand, fueled by stock market gains, along with shrinking supply contributed to the price increase. The number of homes for sale priced at or above $1 million fell 23.8 percent compared to the same period last year, marking three consecutive quarters of declines in luxury supply. The number of homes priced at or above $5 million followed the same trend, down 23.4 percent.

“The stock market hit all-time highs with gains in nearly every sector last quarter, instilling confidence among the wealthiest homebuyers,” said Redfin chief economist Nela Richardson. “As a result, we saw double-digit growth in luxury home sales in the last months of the year.”

Sales of homes priced at or above $1 million were up 15.2 percent from a year ago, and sales of homes priced at or above $5 million were up 13.7 percent.

Luxury homes moved off the market quickly, typically finding a buyer in an average of 75 days, eight fewer days than in the fourth quarter of 2016.

Seven Florida beachfront communities saw the average sale price of luxury homes increase by more than 25 percent year over year. In Sarasota and Delray Beach, luxury prices shot up 45.6 percent and 41.3 percent respectively, the highest fourth-quarter luxury price gains of all cities Redfin analyzed.

San Francisco posted the largest year-over-year decline in luxury home prices, down 12 percent to an average $5.03 million.

While the strong stock market boosted confidence in other housing markets, some would-be luxury buyers in San Francisco held back.

“The luxury market in San Francisco slowed through 2017,” said Miriam Westberg, a Redfin agent from San Francisco. “An unusually low number of initial public offerings among local companies meant fewer cash-flush buyers. Competition, and therefore prices, dropped as many affluent buyers opted to invest in the stock market instead.”

To read the full report, complete with city-specific data and charts, as well as a list of the five highest-priced home sales in Redfin markets in the fourth quarter, visit: https://www.redfin.com/blog/2018/01/luxury-report-q4.html

About Redfin

Redfin (www.redfin.com) is the next-generation real estate brokerage, combining its own full-service agents with modern technology to redefine real estate in the consumer’s favor. Founded by software engineers, Redfin has the country’s #1 brokerage website and offers a host of online tools to consumers, including the Redfin Estimate, the automated home-value estimate with the industry’s lowest published error rate for listed homes. Homebuyers and sellers enjoy a full-service, technology-powered experience from Redfin real estate agents, while saving thousands in commissions. Redfin serves more than 80 major metro areas across the U.S. The company has closed more than $50 billion in home sales.