Source: Statista

“The best camera is the one that’s with you”. This phrase, coined by the award-winning photographer Chase Jarvis, probably best describes the impact that smartphone cameras had and still have on the world of photography. The cameras built into our phones may still be inferior to dedicated digital cameras in general and SLR cameras in particular, but they are constantly getting closer and they have the priceless advantage of always being within reach.

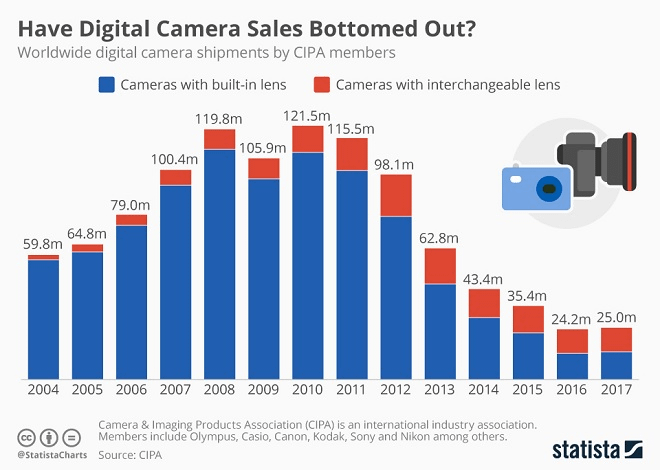

When the first touchscreen smartphones made waves in 2007 and 2008, the camera industry was doing very well. In 2008, members of the CIPA, an association of the world’s most renowned camera makers, shipped almost 120 million digital cameras and probably didn’t worry too much about the upcoming competition. Back then, smartphone cameras were no match in terms of image quality and photo apps such as Instagram or Snapchat hadn’t been invented yet.

10 years later, the situation of the camera industry looks very different. Not only do most people always have their smartphone with them, but the lenses and sensors built into mobile phones are getting better and better. Having raced to ever-higher megapixel counts in the early years of the smartphone boom, recent developments have focused on improving performance in low-light conditions, where the difference between smartphones and dedicated cameras used to be most obvious. As our chart illustrates, global camera shipments by CITA members dropped by nearly 80 percent since peaking in 2010. On a positive note, it appears that the industry managed to stop the bleeding in 2017, when shipments improved by 3 percent after five consecutive years of double-digit declines.