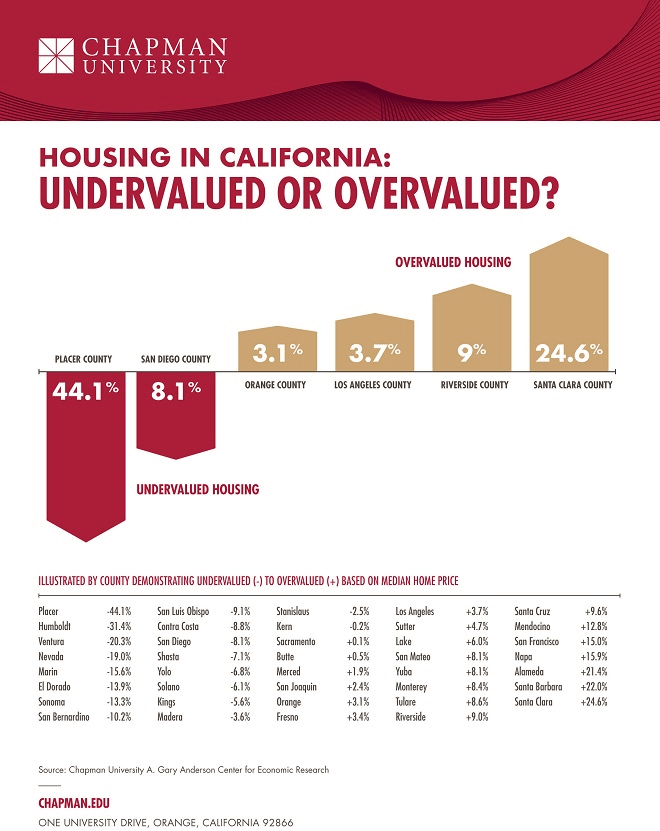

Home Prices Less Affordable Than Historic Averages In 59 Percent of Local Markets; 75 Percent of Local Markets Not Affordable for Average Wage Earners

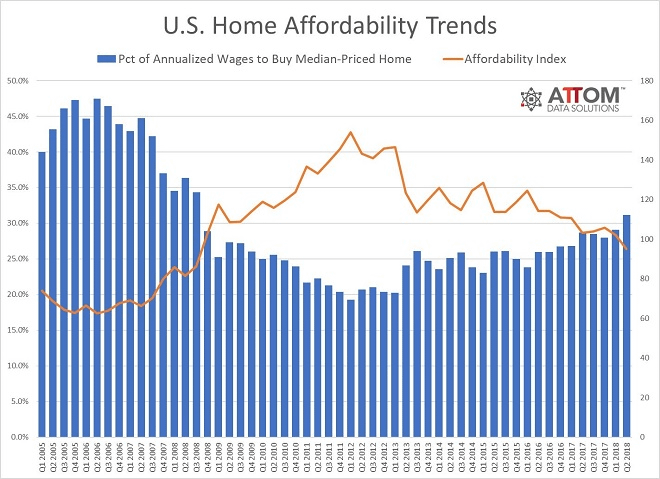

Irvine, CA – June 21, 2018 (PRNewswire) ATTOM Data Solutions, curator of the nation’s premier property database, today released its Q2 2018 U.S. Home Affordability Report, which shows that the U.S. home prices in the first quarter were at the least affordable level since Q3 2008.

The report calculates an affordability index based on percentage of income needed to buy a median-priced home relative to historic averages, with an index above 100 indicating median home prices are more affordable than the historic average, and an index below 100 indicating median home prices are less affordable than the historic average. (See full methodology below.)

Nationwide, the Q2 2018 home affordability index of 95 was down from an index of 102 in the previous quarter and an index of 103 in Q2 2017 to the lowest level since Q3 2008, when the index was 86.

“Slowing home price appreciation in the second quarter was not enough to counteract an 11 percent increase in mortgage rates compared to a year ago, resulting in the worst home affordability we’ve seen in nearly 10 years,” said Daren Blomquist, senior vice president at ATTOM Data Solutions. “Meanwhile home price appreciation continued to outpace wage growth, speeding up the affordability treadmill for prospective homebuyers even without the rise in mortgage rates.”

Q2 2018 U.S. Home Affordability Heat Map by County

Home prices rising faster than wages in 64 percent of local markets

Nationwide the median home price of $245,000 in Q2 2018 was up 4.7 percent from a year, down from 7.4 percent appreciation in the first quarter but still above the average weekly wage growth of 3.3 percent. Since bottoming out in Q1 2012, median home prices nationwide have increased 75 percent while average weekly wages have increased 13 percent during the same period.

Annual growth in median home prices outpaced average wage growth in 275 of the 432 counties analyzed in the report (64 percent), including Los Angeles County, California; Maricopa County (Phoenix), Arizona; San Diego County, California; Orange County, California; and Miami-Dade County, Florida.

Lowest home affordability indexes in Flint, Denver, Santa Fe, Nashville

Counties with the lowest home affordability indexes in Q2 2018 were Genesee County (Flint), Michigan (70); Denver County, Colorado (72); Adams County (Denver area), Colorado (73); Santa Fe County, New Mexico (73); and Wilson County (Nashville area), Tennessee (75).

Among 40 counties with a population of at least 1 million, those with the lowest home affordability indexes in Q2 2018 were Travis County (Austin), Texas (77); Alameda County (San Francisco area), California (81); Santa Clara County (San Jose), California (82); Oakland County (Detroit area), Michigan (82); and San Francisco County, California (83).

Highest share of income needed to buy a home in Bay Area, Brooklyn

Nationwide an average wage earner would need to spend 31.2 percent of his or her income to buy a median-priced home in Q2 2018, above the historic average of 29.6 percent.

Counties with median home prices requiring the highest share of average wage earner income were Marin County (San Francisco area), California (133.2 percent); Kings County (Brooklyn), New York (123.1 percent); Santa Cruz County, California (121.5 percent); Monterey County (Salinas), California (100.3 percent); and San Francisco County, California (97.2 percent).

Counties with median home prices requiring the lowest share of average wage earner income were Wayne County (Detroit), Michigan (13.5 percent); Clayton County, Georgia (13.7 percent); Rock Island (Quad Cities), Illinois (15.8 percent); Saginaw County, Michigan (16.4 percent); and Richmond County (Augusta), Georgia (16.4 percent).

Median home prices not affordable for average wage earners in 75 percent of local markets

An average wage earner would not qualify to buy a median-priced home in 326 of the 432 counties (75 percent) analyzed in the report based on a 3 percent down payment and a maximum front-end debt-to-income ratio of 28 percent.

Counties where an average wage earner could not afford to buy a median-priced home in Q2 2018 included Los Angeles County, California; Cook County (Chicago), Illinois; Maricopa County (Phoenix), Arizona; San Diego County, California; and Orange County, California.

Report Methodology

The ATTOM Data Solutions U.S. Home Affordability Index analyzes median home prices derived from publicly recorded sales deed data collected by ATTOM Data Solutions and average wage data from the U.S. Bureau of Labor Statistics in 432 U.S. counties with a combined population of more than 217 million. The affordability index is based on the percentage of average wages needed to make monthly house payments on a median-priced home with a 30-year fixed rate mortgage and a 3 percent down payment, including property taxes, home insurance and mortgage insurance. Average 30-year fixed interest rates from the Freddie Mac Primary Mortgage Market Survey were used to calculate the monthly house payments. Only counties with sufficient home price and wage data quarterly back to Q1 2005 were used in the analysis.

The report determined affordability for average wage earners by calculating the amount of income needed to make monthly house payments — including mortgage, property taxes and insurance — on a median-priced home with, assuming a 3 percent down payment and a 28 percent maximum “front-end” debt-to-income ratio. For instance, the nationwide median home price of $245,000 in the first second quarter of 2018 would require an annual gross income of $61,709 for a buyer putting 3 percent down and not exceeding the recommended “front-end” debt-to-income ratio of 28 percent — meaning the buyer would not be spending more than 28 percent of his or her income on the house payment, including mortgage, property taxes and insurance. That required income is higher than the $55,393 annual income earned by an average wage earner based on the most recent average weekly wage data available from the Bureau of Labor Statistics, making a median-priced home nationwide not affordable for an average wage earner.

About ATTOM Data Solutions

ATTOM Data Solutions provides premium property data to power products that improve transparency, innovation, efficiency and disruption in a data-driven economy. ATTOM multi-sources property tax, deed, mortgage, foreclosure, environmental risk, natural hazard, and neighborhood data for more than 155 million U.S. residential and commercial properties covering 99 percent of the nation’s population. A rigorous data management process involving more than 20 steps validates, standardizes and enhances the data collected by ATTOM, assigning each property record with a persistent, unique ID — the ATTOM ID. The 9TB ATTOM Data Warehouse fuels innovation in many industries including mortgage, real estate, insurance, marketing, government and more through flexible data delivery solutions that include bulk file licenses, APIs, market trends, marketing lists, match & append and more.

Media Contact:

Christine Stricker

(949) 748-8428

christine.stricker@attomdata.com

Data and Report Licensing:

(949) 502-8313

datareports@attomdata.com

Like this:

Like Loading...

![]()