Source: Statista

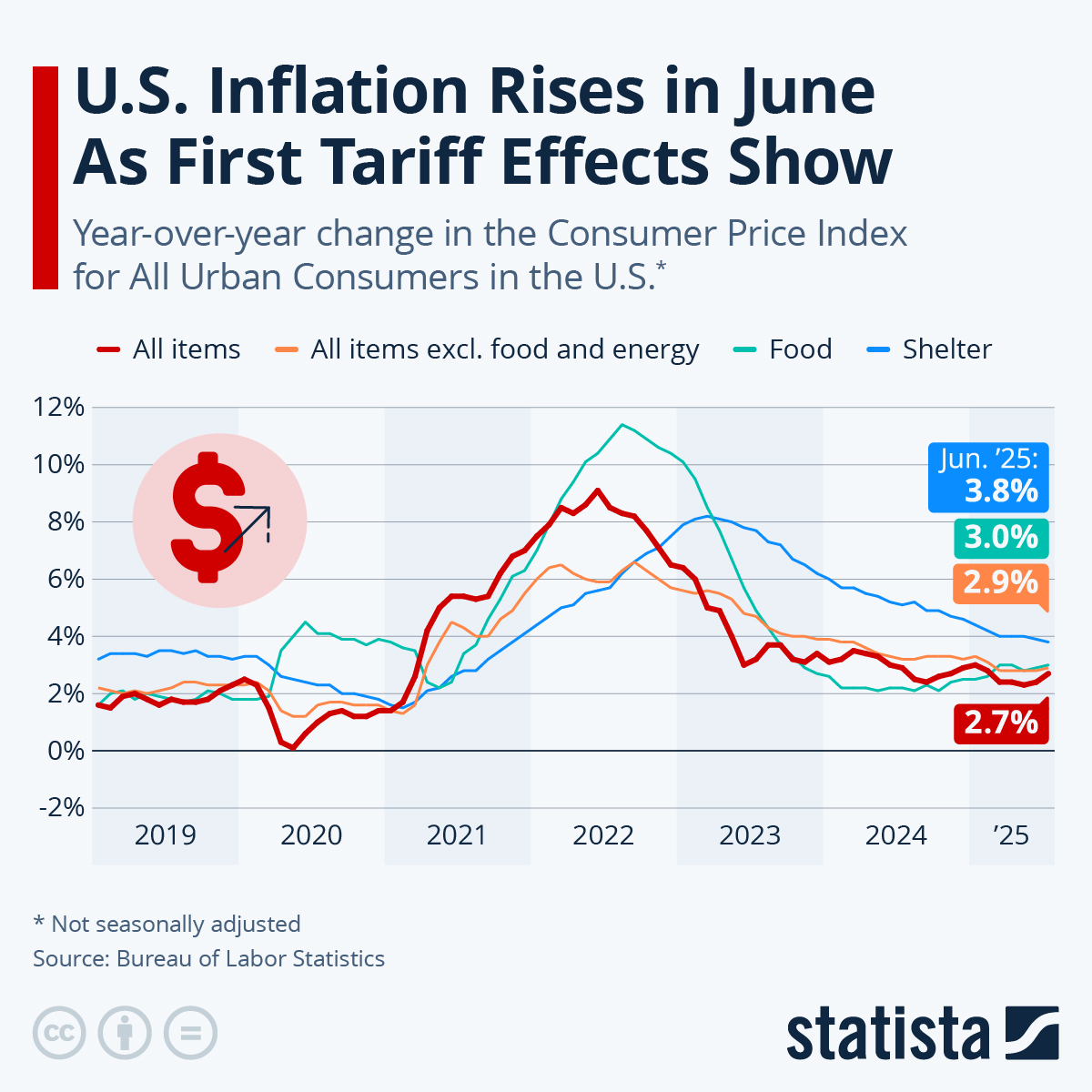

Inflation in the U.S. continued its downward trend in June, falling to the lowest level in more than two years, as the Consumer Price Index for All Urban Consumers (CPI-U) increased by 3.0 percent compared to the same month a year ago. That’s the smallest increase since March 2021, when inflation was just beginning to heat up.

Back then in the spring of 2021, the high inflation readings could largely be explained by the so-called base effect, as prices had fallen sharply at the onset of the pandemic a year earlier, when demand for many goods and services had suddenly dried up. Due to that initial dip in consumer prices, year-over-year comparisons were exaggerated for a while, but towards the end of 2021 inflation became a real concern, which turned into a global crisis when Russia attacked Ukraine, resulting in surging food and energy prices.

The fact that the war in Ukraine has been dragging on for more than a year now is also the reason why the latest, pleasantly low inflation readings should be taken with a pinch of salt. Following Russia’s invasion of Ukraine in late February of 2022, consumer prices, especially for food and energy, climbed sharply, meaning that current price levels are compared to a period of already elevated prices. In fact, energy prices dropped 16.7 percent over the last 12 months, meaning that the overall reading would have been higher without their cooling effect.

The core CPI excluding food and energy increased 4.8 percent – the lowest rate since October 2021 – while the index excluding just energy increased by 5 percent year-over-year. By far the largest driver of inflation in June was the cost of shelter. With rents and owners’ equivalent rents of residences increasing 8.3 and 7.8 percent in June, respectively, the index for shelter accounted for more than 70 percent of the all-items increase.