Only four California markets made May 2018 list, the lowest since the inception of the index

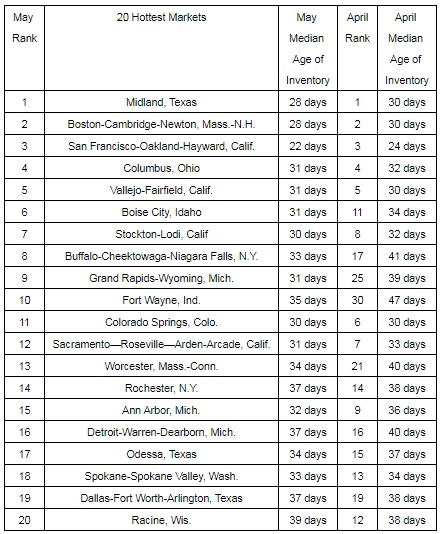

Santa Clara, CA – June 7, 2018 (PRNewswire) New data from realtor.com®, The Home of Home Search℠, reveals Midland, Texas was the nation’s hottest housing market for the second month in a row. Only four California markets appeared on the monthly list of the nation’s 20 hottest markets in sharp contrast of two months ago when more than half of the hottest housing markets were in California.

![]()

May hotness was well distributed with 9 other states represented in the top 20 list: Texas, Massachusetts, Ohio, Idaho, New York, Michigan, Colorado, Indiana, Washington and Wisconsin. In fact, only two months ago the list was dominated by California markets when the top 10 included: San Francisco; Vallejo, Calif.; San Jose, Calif; Santa Cruz, Calif.; Sacramento, Calif.; and Stockton, Calif. Several of these markets made the list of top areas Californians are looking to leave, released last week.

“The California housing market has been hot for a long time – but may be too hot. Our May hotness index further confirms we’re seeing that as prices in California continue to soar, people are increasingly looking elsewhere,” said Javier Vivas, director of economic research for realtor.com®. “As we continue into what we expect to be the hottest home-buying season in history, look for a wide variety of locales to remain red-hot.”

Spill-over of demand for more affordable markets is also as evident as ever in the list, with seven Midwest metros in the top 20, the highest since we started tracking. Markets that saw the largest jump in hotness last month were Fort Wayne, Ind. and Grand Rapids-Wyoming, Mich., which moved up 20 and 16 spots, respectively, since April likely due to their cold climate delaying the start of spring buying season.

Nationally, inventory declined 6 percent year over year in May and increased 6 percent compared to April 2018, according to realtor.com monthly data. Median listing prices only grew 8 percent year over year for the third month in a row, down from 10 percent in February. Part of this deceleration can be attributed to 557,000 new listings hitting the market in May, the highest number since July 2015.

Realtor.com® creates the list by analyzing housing market supply and demand by using realtor.com® listing views as an indicator of demand and median days on market as an indicator of supply.

May 2018 Realtor.com® Hotness Rankings

** Realtor.com® reviewed listing views by market as an indicator of demand and median days on market as an indicator of supply. This analysis led to the identification of the 20 hottest medium-sized to large markets in the country.

Offering the most comprehensive source of information for-sale MLS-listed properties, realtor.com® tracks national housing trends as well as data for the 500 largest U.S. metros. For May trend data on these markets as well other housing trend data, please visit: realtor.com.

About realtor.com®

Realtor.com®, The Home of Home Search℠, offers the most comprehensive source of for-sale MLS-listed properties, among competing national sites, and access to the information, tools and professional expertise to help people move confidently through every step of their home journey. It pioneered the world of digital real estate 20 years ago, and today is the trusted resource for home buyers, sellers and dreamers by making all things home simple, efficient and enjoyable. Realtor.com® is operated by News Corp [NASDAQ: NWS, NWSA] [ASX: NWS, NWSLV] subsidiary Move, Inc. under a perpetual license from the National Association of REALTORS®. For more information, visit realtor.com.

Contact:

Lexie Puckett Holbert

lexie.puckett@move.com