LendingTree uses anonymized customer data to determine where people were most likely to request that a fraud alert be placed on their credit reports

Charlotte, NC – April 11, 2018 (PRNewswire) LendingTree®, the nation’s leading online loan marketplace, today released the findings of its study on where people are most likely to have asked a credit bureau to place a fraud alert on their credit report.

With millions of Americans affected by data breaches every year, such as recent revelations at Uber and Equifax, LendingTree decided to look at anonymized data from a sample of the over 7 million My LendingTree users to see where people are most likely to have asked a credit bureau to place a fraud alert on their credit report. My LendingTree, available online and at app stores, offers free credit monitoring that includes alerts within 30 minutes of activity on your credit report.

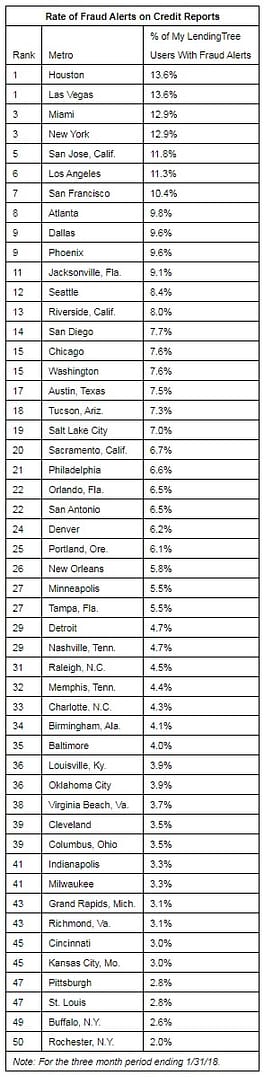

Key findings of the study:

- The average rate of fraud alert requests among all cities reviewed is 6.4 percent.

- Las Vegas and Houston tie for the highest rate of fraud alerts, at 13.6 percent.

- Miami and New York are close behind, tied at 12.9 percent.

- Rochester, N.Y. has the lowest rate of people requesting fraud alerts at 2 percent. Nearby Buffalo, N.Y. has 2.6 percent.

Big cities lead the pack

1 (tie) – Las Vegas, NV

My LendingTree users with fraud alerts: 13.6%

1 (tie) – Houston, TX

My LendingTree users with fraud alerts: 13.6%

3 (tie) – Miami, FL

My LendingTree users with fraud alerts: 12.9%

3 (tie) – New York, NY

My LendingTree users with fraud alerts: 12.9%

5 – San Jose, CA

My LendingTree users with fraud alerts: 11.8%

Rust Belt and Missouri cities have the fewest alerts

50 – Rochester, NY

My LendingTree users with fraud alerts: 2%

49 – Buffalo, NY

My LendingTree users with fraud alerts: 2.6%

47 (tie) – St. Louis, MO

My LendingTree users with fraud alerts: 2.8%

47 (tie) – Pittsburgh, PA

My LendingTree users with fraud alerts: 2.8%

For more information on the study, visit https://www.lendingtree.com/finance/metros-with-most-fraud-alerts/

About LendingTree

LendingTree (NASDAQ: TREE) is the nation’s leading online loan marketplace, empowering consumers as they comparison-shop across a full suite of loan and credit-based offerings. LendingTree provides an online marketplace which connects consumers with multiple lenders that compete for their business, as well as an array of online tools and information to help consumers find the best loan. Since inception, LendingTree has facilitated more than 65 million loan requests. LendingTree provides free monthly credit scores through My LendingTree and access to its network of over 500 lenders offering home loans, personal loans, credit cards, student loans, business loans, home equity loans/lines of credit, auto loans and more. LendingTree, LLC is a subsidiary of LendingTree, Inc. For more information go to www.lendingtree.com, dial 800-555-TREE, like our Facebook page and/or follow us on Twitter @LendingTree.

MEDIA CONTACT:

Megan Greuling

(704) 943-8208

Megan.greuling@lendingtree.com